Blog

Intermodal Spot Rates March 2024: A look by market

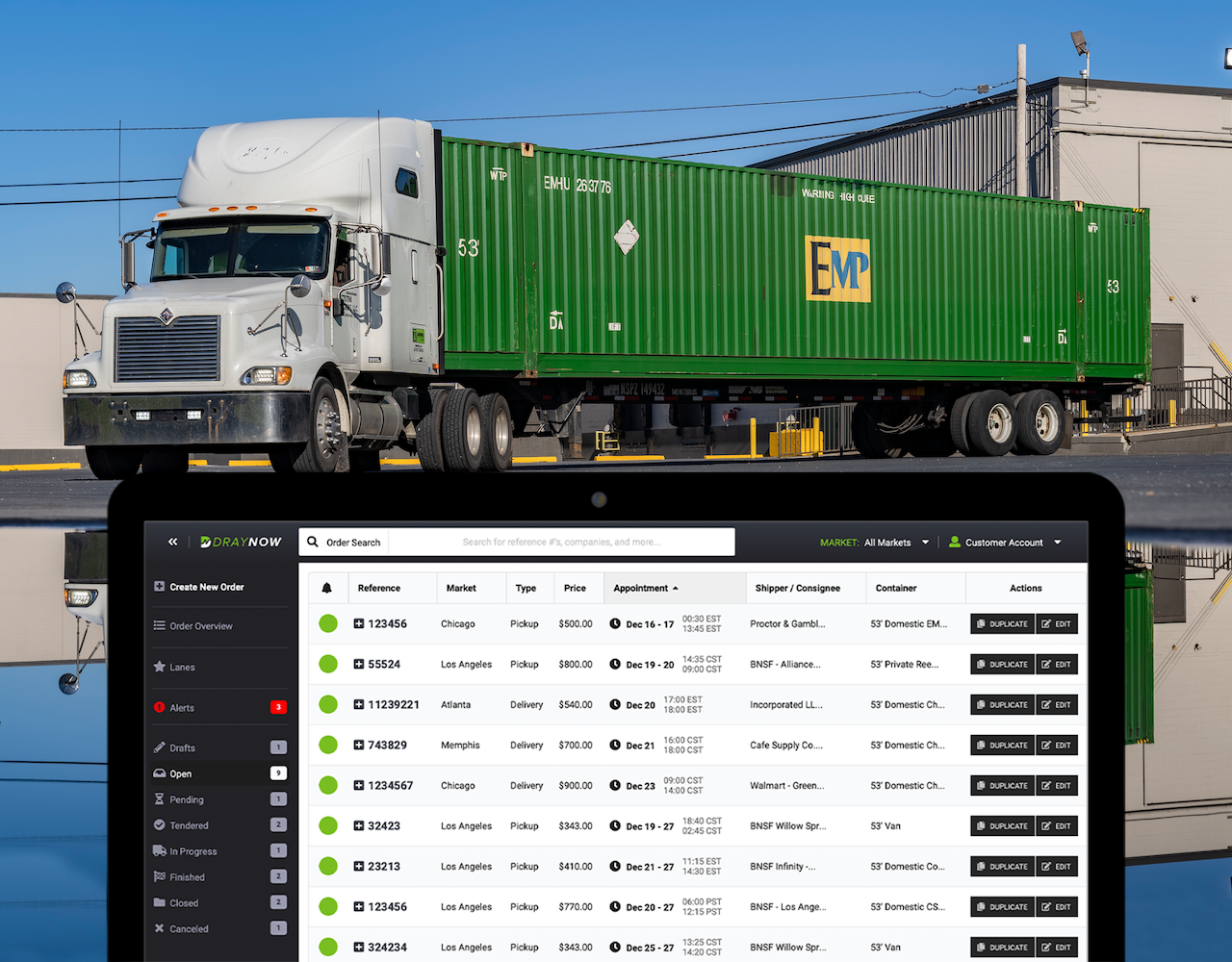

Read MoreBe The First to Know When Freight Is Available

Read MoreDrayNow’s Scalable Memphis Intermodal Drayage Service

Read MoreGet Transparent Pricing For Your Intermodal Drayage Loads

Read MoreIntermodal Spot Rates February 2024: A look by market

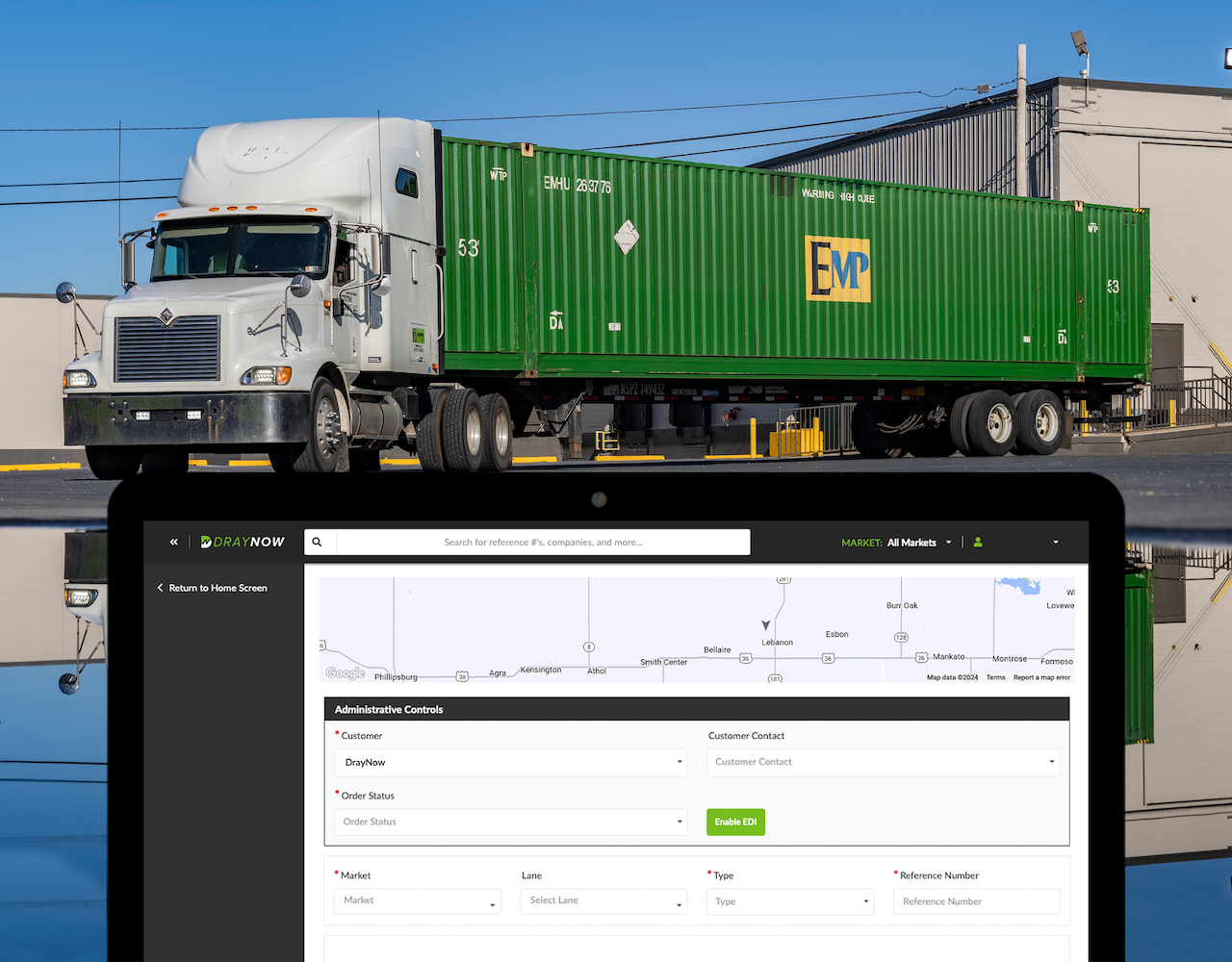

Read MoreHow to Tender Intermodal Drayage Loads to DrayNow

Read MoreHow Long-Haul Truck Drivers Can Find Local Intermodal Loads

Read MoreHow To Get an IMC Account with DrayNow

Read MoreIntermodal Spot Rates January 2024: A look by market

Read MoreRecording In and Out Times on Intermodal Load Documents

Read More

Page

1

of

27

Next

Get Started

Ready for a new way to haul?

Download the app to get started with DrayNow.